Most of us have seen the headlines about the Biden-Harris administration’s goal of cleansing the U.S. economy of junk fees, or extra, (read: hollow) costs for purchasing typical products and services.

Indeed, the “Junk Free Prevention Act” aims to reduce or eliminate predatory and unnecessary junk fees in prominent industries.

But what are junk fees, exactly?

How do they appear in daily commerce? Which industries can you expect to encounter these fees, and is there anything you can do about them should you find yourself facing an upcharge upon purchase?

Let’s explore below.

What Are Junk Fees?

Junk fees are extra fees added to the cost of a product or service that are not usually included in the listed price of that product or service. Instead of being included in the upfront price, the fee is added at the time of payment. This pricing strategy is often used to raise the cost of a product or service without raising the listed price.

Why are junk fees concerning? Because they intentionally mislead customers into paying more for the same product or service. Junk fees also make it very difficult for consumers to properly evaluate one purchasing option from another.

According to Consumer Reports, 85 percent of people have encountered a junk fee. These fees carry an average cost of $30-35. In aggregate, these fees can amount to thousands annually.

Which Industries Are Junk Fees Most Common?

Industries where you can expect to encounter junk fees include:

-Banking

-Utilities

-Live ticket vending

-Telecommunications (i.e. internet, cable, phone)

-Investment services

-Rental agencies

-Airlines

-Hotels

Different Types of Junk Fees

According to Whitehouse.gov, all junk fees fall into one of the below categories:

-Mandatory fees that often hide the full price (e.g. service fees on a concert or live sporting event).

-Surprise fees that consumers learn about after purchase (e.g. “family seating fees” charged by airlines).

-Exploitative or predatory fees (e.g. bank overdraft fees).

-Fraudulent fees (e.g. a bank account that is advertised as having no fees despite carrying significant potential penalty fees, such as for canceling service–also common in telecommunication companies).

On top of making it more difficult to be a judicious consumer, junk fees can be difficult to challenge. Just 35 percent of consumers enjoy a positive resolution after raising a dispute.

Until the “Junk Free Prevention Act” is enacted into law, it’s important to avoid being taken advantage of. Always be sure to fully research products or services before making a purchase, including any user reviews. Make sure to look for any extra fees that may be included on product pages, checkout screens or any fine print.

When comparing offerings among a few providers, pay attention to the total cost (not just the base cost) and find out each charge that contributes to that total cost. If you have any doubts, ask questions before you’re in the moment of purchase so you’re not taken by surprise.

What Are Hotel Junk Fees?

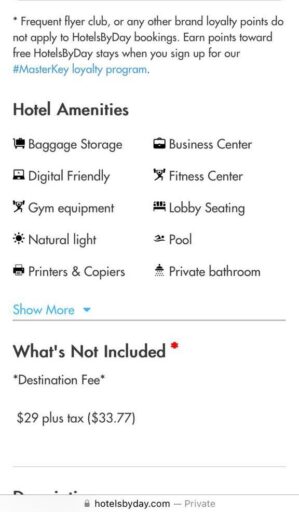

Hotel junk fees are extra charges on top of the advertised room rate. These fees are used to increase the cost of the room without raising the base price, and can include things like internet access, resort fees, parking fees, and early check-in/late check-out fees.

Hotel junk fees can be especially concerning for travelers because they may not be aware of the fees until after their booking is complete and they show up to the hotel to check-in. Additionally, many of the fees are mandatory, so customers have no choice but to pay them or leave.

To avoid being taken by surprise, it’s important to research the hotel before you book. If you’re booking with an online travel agency booking engine like HotelsByDay.com, you’ll want to pay attention to the hotel listing page to see “what’s not included” in the rate you’re paying for.

Trust us when we say we absolutely loathe junk fees. We hate that they exist in our industry. However, until governmental powers take action into their own hands, the only thing we can do is be clear about these fees so that you don’t end up paying for something you feel misled about or taken advantage of.

Image credit:

Featured image “US 100 Bill” by Adam Nir via Unsplash

Want to Earn Points Toward Free Stays?

Being a MasterKey member means you earn points on every HotelsByDay booking you make. Sign up for free today!